The global fiberglass market is experiencing robust growth, driven by increasing demand across diverse industries. Here’s a comprehensive overview:

Market Size and Forecast:

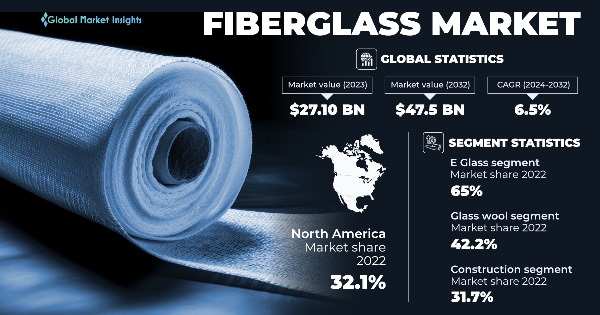

- The global fiberglass market was valued at approximately USD 13.4 billion in 2020 and is projected to reach USD 20.3 billion by 2028, growing at a CAGR of 5.5% during the forecast period (2021-2028).

Based on glass type, E Glass, known for its cost-effectiveness and general-purpose applications, traditionally holds the largest market share around 65% in 2022 catering to a wide range of industries including construction, automotive, and aerospace. ECR Glass, valued for its enhanced corrosion resistance, follows closely, particularly in sectors where durability is paramount, such as marine and chemical processing. Meanwhile, H Glass, celebrated for its high tensile strength, gains prominence in aerospace and automotive applications. AR Glass, favoured for its alkali resistance and electrical insulation properties, is significant in the construction and electronics sectors. S Glass, known for its high tensile modulus, finds its niche in specialized aerospace and defence applications. The “Others” category accommodates various glass types tailored for specific and evolving market niches. The market dynamics are driven by the unique attributes and performance characteristics of these glass types, each catering to distinct industry needs.

Segmentation:

By Type:

- Glass wool (40% market share): Widely used in insulation applications due to its excellent thermal and acoustic properties.

- Direct roving (25% market share): Primarily used in composite materials, particularly in the automotive and aerospace industries.

- Chopped strand (20% market share): Utilized in reinforced plastics and composites, known for its strength and durability.

- Woven roving (10% market share): Employed in high-performance composites, offering enhanced strength and stiffness.

- Other types (5% market share): Includes specialized types like continuous filament yarn and mat, used in specific applications.

By Application:

- Construction (40% market share): Dominated by insulation, roofing, and building materials, where fiberglass provides excellent thermal and acoustic insulation, along with structural reinforcement.

- Automotive (25% market share): Used in body panels, chassis, and interior components to reduce vehicle weight and improve fuel efficiency.

- Wind energy (15% market share): Essential in wind turbine blades, providing structural support and lightweight properties.

- Consumer goods (10% market share): Used in various consumer goods, such as appliances, furniture, and sports equipment.

- Aerospace and defense (5% market share): Employed in aircraft components, satellites, and military equipment, where its high strength-to-weight ratio is crucial.

- Other applications (5% market share): Includes a variety of other applications like marine, electronics, and agriculture.

By Region:

- Asia Pacific (45% market share): Leading the market due to rapid industrialization, infrastructure development, and increasing construction activities.

- North America (25% market share): Strong demand from the automotive, construction, and wind energy sectors.

- Europe (20% market share): Mature market with significant demand for fiberglass in various applications, driven by government regulations and sustainability concerns.

- Latin America (5% market share): Growing market, with increasing infrastructure investments and industrialization.

- Middle East and Africa (5% market share): Emerging market with potential for growth, driven by economic development and infrastructure projects.

Key Growth Drivers:

- Growing construction industry: The increasing demand for insulation materials, roofing, and other building materials is driving the fiberglass market.

- Rising adoption in automotive: The shift towards lightweight vehicles for improved fuel efficiency is fueling the demand for fiberglass in automotive applications.

- Wind energy expansion: The growing wind energy sector is driving the use of fiberglass in wind turbine blades.

- Focus on energy efficiency: Fiberglass offers excellent thermal and acoustic insulation, contributing to energy savings and environmental sustainability.

- Emerging markets growth: Rapid industrialization and infrastructure development in developing economies are driving the demand for fiberglass.

Challenges:

- High production costs: The cost of raw materials and energy impacts the profitability of fiberglass manufacturers.

- Stringent regulations: Environmental regulations and safety concerns can impose challenges on the industry.

- Fluctuating raw material prices: The price volatility of key raw materials like silica sand and soda ash affects production costs.

- Competition from alternative materials: Materials like carbon fiber and natural fibers are emerging as potential alternatives.

Key Players:

- Owens Corning (USA)

- Jushi Group (China)

- Nippon Electric Glass Co., Ltd. (Japan)

- Taiheiyo Cement Corporation (Japan)

- Chongqing Polycomp International Corporation (China)

- Johns Manville (USA)

- Saint-Gobain Vetrotex (France)

- 3B – the fiberglass company (Germany)

Overall:

The global fiberglass market is poised for continued growth, driven by its versatile properties, increasing demand from key end-use industries, and the rising focus on sustainability. The market is expected to benefit from technological advancements, innovation, and the increasing adoption of fiberglass in emerging applications.

Formulas:

- CAGR (Compound Annual Growth Rate): 𝐶𝐴𝐺𝑅=(𝐹𝑖𝑛𝑎𝑙𝑉𝑎𝑙𝑢𝑒𝐼𝑛𝑖𝑡𝑖𝑎𝑙𝑉𝑎𝑙𝑢𝑒)1𝑁𝑢𝑚𝑏𝑒𝑟𝑜𝑓𝑌𝑒𝑎𝑟𝑠−1CAGR=(InitialValueFinalValue)NumberofYears1−1

This formula calculates the average annual growth rate over a specific period.